How KiwiBank curbed application rejections with an innovative location data solution

KiwiBank won Best Paid Search Campaign and Most Effective Use of Data at The Drum Awards for Digital Advertising APAC 2022 for its innovative responsible lending campaign. Here, we examine how the idea came to life.

KiwiBank developed an innovative solution to reducing credit card application rejections / Adobe Stock

New Zealand’s state-owned bank KiwiBank took on a challenging mission to ensure that no one need to be rejected for a credit card in New Zealand. With a powerful data analytics strategy, the bank saw major success.

Advertisement

The brief

Reforms to the Credit Contracts and Consumer Finance Act (CCCFA) late last year introduced new challenges to the financial services industry in New Zealand. Despite the aim of helping to curb predatory lending practices, the changes made it more difficult to process and approve loan applications by adding new due diligence requirements and processes for all lenders. At KiwiBank, the impact was immediate: the organization saw processing times quadruple, which in turn hurt operations and customer experience.

Plus, changes to the CCCFA drove up decline rates – a result that further frustrated customers and damaged brand trust for lenders like KiwiBank.

Advertisement

KiwiBank needed a new strategy to address a simple fundamental truth: from nightclub entry to a flight upgrade to a decision on a credit card, no one likes to be declined. The bank needed a new solution to effectively identify consumers with credit scores below required approval levels in order to provide a better customer experience and outcome by avoiding a decline and reducing processing times.

KiwiBank tasked partners Equifax and OMD with helping to revamp its pre-screening process. Though it had previously developed compliant pre-screening tools for display and social campaigns, the bank wanted to extend the power of pre-screening to search, which accounts for 14% of total traffic to KiwiBank’s credit card webpages.

The team laid out a simple goal: to reduce the rate of declined card applications by 10% over the first six months and up to 15% after one year.

The idea

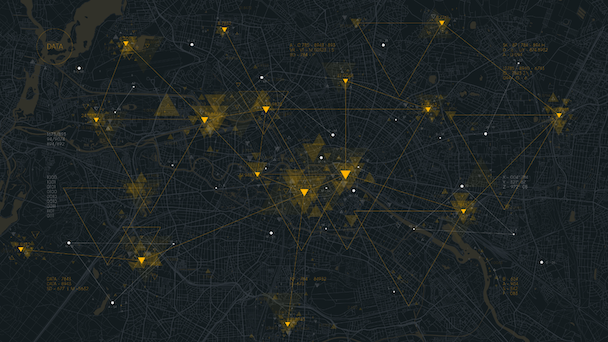

Equifax’s GeoRisk product analyzes credit risk at a neighborhood level – and while this tool was ruled out because its capabilities were limited to major towns, cities and regions and wouldn’t provide the kind of granular insights KiwiBank needed – Equifax software included one tool that might do the trick. With this tool, the team could create radii around specified locations down to just one kilometer and apply media bid weightings to those predetermined areas using Google Search Ads 360.

Still, the team faced an issue: how to take the diverse data it had on hand and translate it into a custom set of radius areas.

The solution? KiwiBanks used specialist geospatial analysis tools to identify areas of the highest density of consumers who did not meet the bank’s credit card approval threshold. Using a variety of different data sources, the team was able to develop a single composite score based on data like credit scores, defaults, hardship flags and more.

With this information, it was able to identify key ‘hot spots’ and allowed KiwiBanks to create a number of zones that would see consumers blocked rather than targeted in paid search ads. It was a tight balancing act as the bank didn’t want to unnecessarily lose good prospects and ultimately hamper acquisition. The data analysis and optimization resulted in a plan that blocked only 20% of New Zealand’s adult population but 85% of consumers who didn’t meet KiwiBank’s lending criteria.

OMD and Equifax ultimately delivered a plan of more than 200 strategically-placed locations with various radius sizes and custom bid weightings that could be used to intelligently apply search ads.

Advertisement

The results

The results of the campaign outperformed expectations. KiwiBank saw a 21% reduction in declined applications, compared to the bank’s goal of 10%.

At the same time, it also saw approval rates grow 273% for new applications that came through paid search. This figure is especially impressive considering that it happened within a period in which total credit card approval rates in the market dropped by 24.2% due to economic conditions and changes to the CCCFA.

Despite the costs of implementing the new search solution, the return on ad spend came out around 3:1, or 294%.

Though this strategy was implemented for a limited three-month trial, KiwiBank plans to continue using it – not only for credit card applications but for other products, too. The bank anticipates that, on an annual basis, it will result in thousands of new customers and hundreds of thousands of dollars in incremental revenue – while improving efficiencies for the lending team and making the customer journey more seamless.

This campaign was a winner at The Drum Awards for Digital Advertising APAC 2022. You can see all the winners here. The Drum Awards for Marketing are currently open for entry. Find out how you can enter now.

Advertisement